pay utah state property taxes online

Pub 2 Utah Taxpayer Bill of Rights contains additional information regarding taxpayer rights and responsibilities. Rememberyou can file early then pay any amount you owe by this years due date.

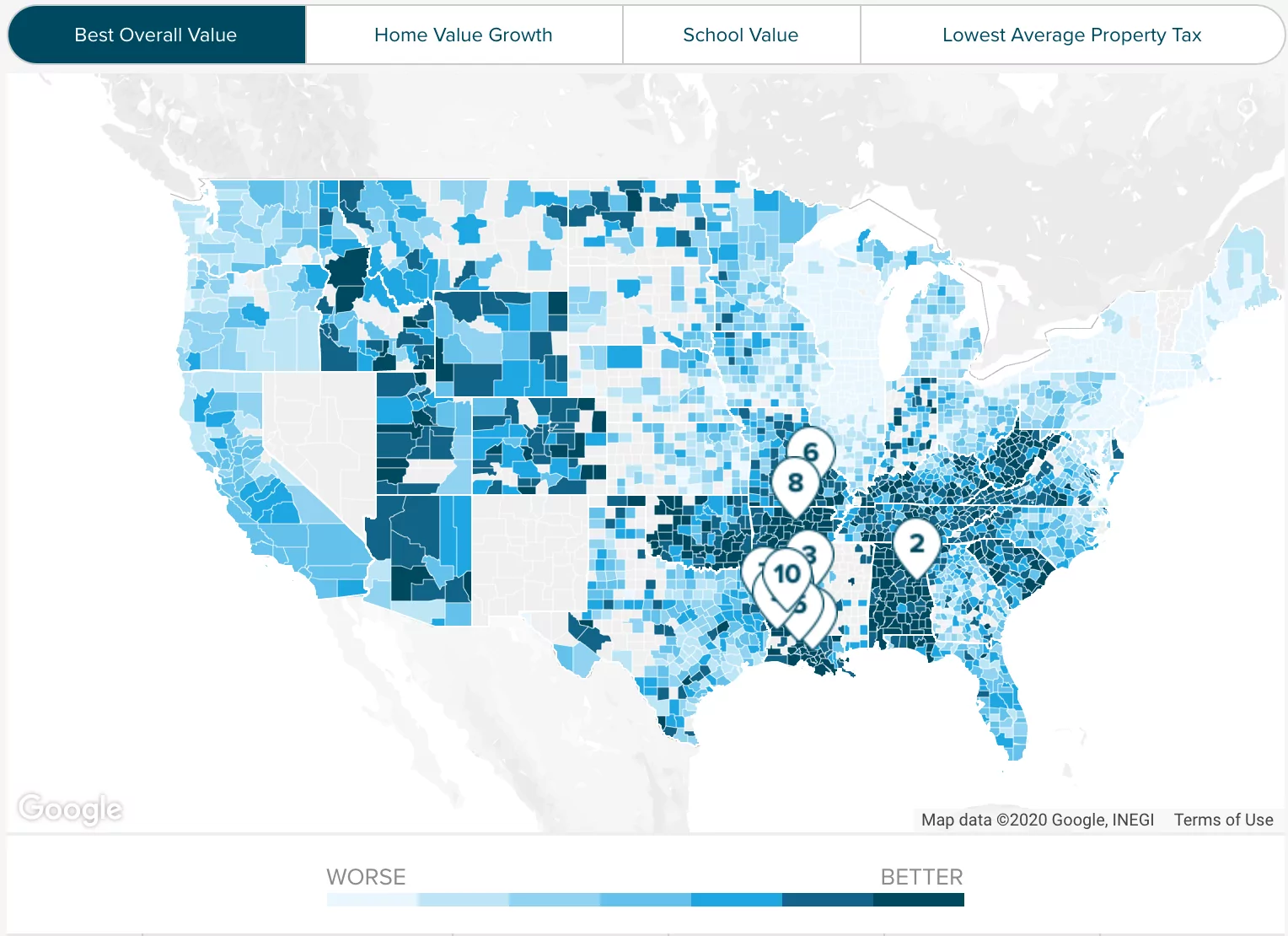

Property Taxes By State County Lowest Property Taxes In The Us Mapped

On November 30 or 2.

. Filing Paying Your Taxes. This web site allows you to pay your Utah County Personal Property Taxes online using credit cards debit cards or electronic checks. This web site allows you to pay your Utah County real and business personal property taxes online using credit cards debit cards or electronic checks.

For your protection credit card companies may deny large online. Pay Manufactured Home Tax. File electronically using Taxpayer Access Point at taputahgov.

Form of Payment Payment Types Accepted Online. What You Need To Pay Online. Pay Online You may pay your tax online with your credit card or with an electronic check ACH debit.

Utahs average effective property tax rate is just 058 good for 11th-lowest in the country. Please contact us at 801-297-2200 or taxmasterutahgov for more information. It could have been better.

Follow the instructions at taputahgov. Confirmation acknowledges receipt of your information and intent to pay property taxes. No convenience fee is charged when you pay with an e-check.

Authority levy depends upon enabling statutes. How was your experience with papergov. Utah State Tax Commission Property Tax Division Rev.

Please contact us at 801-297-2200 or. Make your check or money order payable to the Utah State Tax Commission. These are the payment deadlines.

Online REAL Estate Property Tax Payment System. Liqour Taxes How High Are Distilled Spirits Taxes In Your State. Online payments may include a service fee.

Property taxes may be levied by the State of Utah and most of its political subdivisions including counties all cities and towns all school districts and most special service districts. Paid online or by phone with a receipt transaction time before midnight Mountain Standard Time on November 30th. What You Need.

You may also pay with an electronic funds transfer by ACH credit. There is no fee when paying by e-check through the online system. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

Online PERSONAL Property Tax Payment System. Table of Contents. Please call 801-451-3243 for assistance or for IVR telephone payments 877 690-3792 Jurisdiction Code 5450 Pay Property Taxes Online or By Phone Payments made after October 1 will not show on your Tax Notice that you will receive by the end of October.

Your Personal Property Account Number 2. Standard 5 Personal Property Valuation Property Tax Division Standards of Practice Page i. A convenience fee is charged when you pay your taxes using a credit card.

Here the typical homeowner can expect to pay about 1900 annually in property tax payments. TAP includes many free services such as tax filing and payment and the ability to manage your account online. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov.

Cell Phone Taxes And Fees 2021 Tax Foundation. You will pay the remaining balance or have the option to authorize SLCo to make the final withdrawal for. We accept Visa MasterCard Discover and American Express.

Online Instructions Click on the green Click Here to Pay button below. Pay Real Property Tax. See Payment Alternatives for more information about different methods of payment.

Be Postmarked on or before November 30 2021 by the United States Postal Service or 3. If you do not have these please request a duplicate tax notice here. This website is not available during scheduled system maintenance.

Pay Business Personal Property Tax. Please note that for security reasons Taxpayer Access Point is not available in most countries outside the United States. This website is provided for general guidance only.

Make sure you put your name and account number on your payment. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. For security reasons TAP and other e-services are not available in most countries outside the United States.

This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. Section VI 4 General Information 4 Purpose 4 Scope 4. See Taxpayer Access Point TAP for electronic payment options including setting up a payment agreement.

This web site allows you to pay your Utah County real property taxes online using credit cards debit cards or electronic checks. Weber County property taxes must be brought in to our office by 5 pm. Pay for your Utah County Real Property tax Personal Property tax online using this service.

Please note that for security reasons Taxpayer Access Point is not available in most countries outside the United States. Pay by Mail You may also mail your check or money order payable to the Utah State Tax Commission with your return. Your bank may request the following information in order to process an e-check debit payment request.

Please contact your financial institution to verify that funds have been transferred. Mail your payment to 210 North 1950 West Salt Lake City UT 84134-7000. You can also pay online and avoid the hassles of mailing in a check.

You will need your property serial numbers. Overview of Utah Taxes. Payments can be made online by e-check ACH debit at taputahgov.

You can pay online with an eCheck or credit card through Taxpayer Access Point TAP. Scheduled maintenance times are approximate and may be extended due to unusual circumstances. In case you missed it the link opens in a new tab of your browser.

Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824. Nine electronic bank account withdrawals can be set up using this calculation 2021 taxesby 9 months 9 monthly payments.

Nightly scheduled maintenance is done from 1155 PM to 500 AM MST. Property taxes can be paid online by credit card. Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Retirement.

Taxpayers paying online receive immediate confirmation of the payments made. It does not contain all tax laws or rules. Pay utah state property taxes online.

Property Taxes Calculating State Differences How To Pay

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

28 Key Pros Cons Of Property Taxes E C

Is It A Good Idea To Prepay Property Taxes Embrace Home Loans

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Property Taxes Calculating State Differences How To Pay

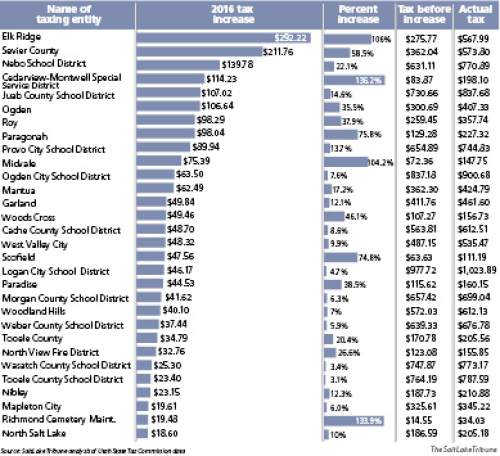

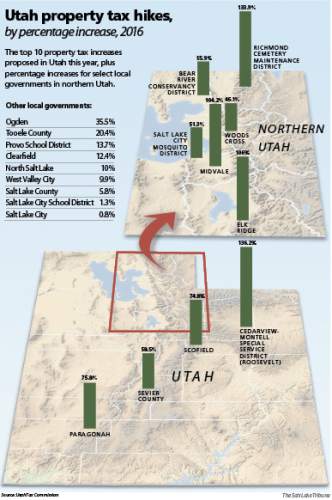

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune

Alameda County Ca Property Tax Calculator Smartasset

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

All Utahns Pay Taxes But The Poor Pay A Greater Percent Of Their Income Than The Rich Paying Taxes Family Income Income

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune

Property Tax By State Ranking The Lowest To Highest

States With The Highest And Lowest Property Taxes Property Tax States High Low

States With Highest And Lowest Sales Tax Rates

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)